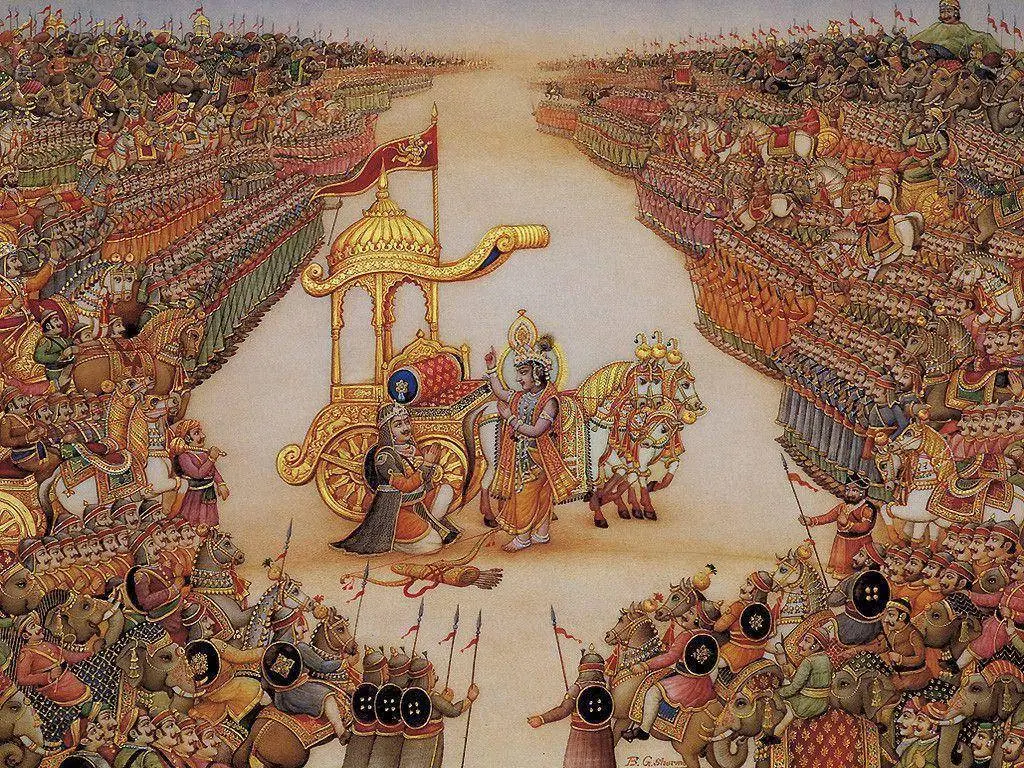

Dharma

Man is a slave to wealth, but wealth is the slave of no man. -Bhisma, Mahabharata

With AI the ability to build a business has never been easier and cheaper. We are really in a period of time when starting a business is crazy easy.

Businesses

opsZero

| Venture | Description |

|---|---|

| opsZero | A DevOps and SRE company that helps businesses build and operate their infrastructure. |

| MakeProspect | A sales prospecting tool that helps businesses find and engage with potential customers. |

| DiscountCloud | A cloud cost optimization service that helps businesses save money on their cloud bills. |

| Deepfacts.ai | An AI-powered data analysis platform that helps businesses make better decisions. |

Yerra India

| Venture | Description |

|---|---|

| Yerra India | A platform that helps businesses find and hire top talent in India. |

| Yerra Realty | A real estate company that helps people buy, sell, and rent properties in India. |

| Surya Health | A healthcare company that provides affordable and accessible healthcare services in India. |

| Jnana Press | A publishing company that specializes in ancient Indian texts and literature. |

Principles

Mission

Serve Others

Self

Whatever you do, Arjuna do it as an offering to me. Whatever you say or eat or pray or enjoy or suffer. Bhagavad Gita 9.27

- Love. Everything starts with love without it there is only anger and darkness.

- Humility. Be humble and show respect to others and ourselves. Respect our level of knowledge. If someone else can teach us something, learn from them. Work with others in a non-zero-sum way seeking to grow the pool for everyone.

- Skin in the Game. No one is accountable for the actions we take but ourselves. We are responsible for both the good and the bad. It is easy to take praise but harder to take blame. Finger-pointing doesn’t solve problems. If shit hits the fan, acknowledge failure, and pick up a mop.

- Maslow. To be our best selves, we need to fulfill our Maslow’s Hierarchy of Needs. We develop every part of ourselves.

- Lever. Every single person has 24 hours a day. Learn to manage it and lever it with technology. Technology and automation are friends, allowing us to achieve more with less.

- Perceive. To know where the world is going is to take part in it by synthesizing knowledge, getting deep by challenging our thinking, applying it, and sharing our learning. To do this well, we dive deep into problems by biasing for action allowing us to internalize knowledge. We act by focusing on being less wrong as opposed to being more right.

Team

It is in action alone that you have a claim, never at any time to the fruits of such action. Never let the fruits of action be your motive; never let your attachment be to inaction. Bhagavad Gita

- Customer First. A business exists to create the most value for the customer from their next alternate. So we start with the customer and work backwards. We understand the customer’s pain and figure out how we can use our capabilities to provide them the best value. By diving deep into providing value to our customers we will be able to reinvest the knowledge we gain into creating additional capabilities, repeating the cycle. Further, we build deep, long-term relationships that span years and hopefully decades. Trust and commitment to do good on their behalf are paramount. We figure out their pain points, deeply understand their needs, and help them be better so they can, in turn, do the same for their customers.

- Hacker. Use fewer resources to accomplish more. Plenty creates lethargy. Lethargy leads to destruction from competition. Fewer resources forces survival and generates the scar tissue needed to weather pain and deliver results.

- Observe, Orient, Decide, Act. Create continuous improvement through high-tempo experimentation. If trail and error works for mother nature it will work for us. Failure is a means to learn, not something to be punished. Fail fast with small bets and learn from those failures to improve the odds of the big bets succeeding.

- Think Long-Term. Build a long-term vision and work backward to achieve it. Don’t get distracted by short-termism and the whims of market forces. Build methodical structures that can evolve to the goal. We build mental models of the world and markets to see how we can fulfill needs. We take market intelligence and customer’s needs to make small bets. These small bets allow us to test the water and gain knowledge. Once a bet is validated we expand with focus and force. This incrementalism allows us to continuously pathfind into new markets expanding our capabilities.

- People, Ideas, Technology. In That Order. People are the foundation of everything we do. We give our team autonomy to work and use their ingenuity and knowledge to help our customers. Our only constraint is they do so within the bounds of our Principles. By being principles-driven instead of process-driven, we can adapt to changing circumstances. Work is a means to enable others. A garbageman picking up trash enables an artist to work on a masterpiece. Technology exists to enable People.

- Mastery. Flow is achieved when everyone performs their role, passing the baton to the next person. When each person performs their task well and the next person does not have to redo work we increase quality. By achieving quality we reduce costs and drive more value to the Customer.

Playbook

The business model is to use decentralized teams completely run from India with AI to fill in gaps.

- Each business has a sales lead, a technical lead, and a general manager.

- Each business optimized around its P&L.

- Each business is that it optimizes with a focus on becoming cash flow positive as fast as possible.

Infra

Our ventures are built with Jugaad as the primary driving force: be as cheap as possible and build as fast as possible. We do not plan to conquer the world, we try to address a customer need as fast as possible and then iterate what we need from there. Our teams are loosely coupled partnerships of vendors and contractors coordinated on WhatsApp and Github.

In this regard we use three main tools to run our ventures:

- Apple Notes App. Yeah, a lot can be done with this app. Nearly everything for a venture should be a single note within this app.

- WhatsApp. Nearly all communications happens through WhatsApp Groups.

- GitHub. The operations of the business runs through Github and as much of it is run under the abhiyerra user as possible.

We build businesses that have the following characteristics:

- Serve People. Build things that help better the world.

- Domain Expertise. Build ventures with others who can bring in their expertise.

- Low Cost. Use technology and automation to drive down cost across every part of the business.

- TEAM.

- GROWTH Planner. 7 Powers framework for Growth Hacking.

- SUPPORT.

- LEDGER. Deming's Statistical Process Control.

Our operations is focused on low cost and high automation. We minimize the tools people use and force everything to run within the following tools:

- Github. We run the entire operation through Github. Running the venture within a monorepo.

- Issues. All tasks are tracked in Github issues.

- Actions. All automation is run through Github actions.

- Code. All code is stored in Github.

app. The backend code.www. The frontend code.infra. The terraform code.Makefile. The makefile that runs the entire operation.

- WhatsApp. Communication for collaboration. WhatsApp because it is the most used.

- Third-Party Distribution. Launch using third party marketplaces.

Partners & Team

We work with domain experts to build new companies using our Playbook. We provide the capital, infrastructure, and support to help startup.

| Member | Title | Role | Description |

|---|---|---|---|

| You | CEO | Domain Expert, Customer Support, Sales | Provide expertise and manage customer relationships. |

| Us | CTO | IT, Management, Business Operations, Capital | Provide the operational support. |

Every Project has Three Things: Revenue, Support, Ledger

| Group | Description |

|---|---|

| Ledger | People and Finance. |

| Growth | Sales, Marketing and Partnerships. |

| Support | Customer Support and Technology. |

The goal is to optimize these three parts continuously with Deming’s Statistical Process Control.

The best way to judge people is to have them do problems right off the bat and see how they work with your team. Unfortunately, I do think algorithmic problems have a place for companies like Google and Amazon which are triaging through thousands of candidates. However, startups doing this seems like a bad call. Most of the time as a startup you are trying to figure out not if someone can do a bureaucratic task like pulling an algorithm out of their ass, but do they know the context of the code they are building. Can they understand the library ecosystem and use existing tooling.

One effective process I’ve found in weeding out ineffective people is hire them fast and put them on simple problems in the codebase that shouldn’t take more than an hour to accomplish. If they solve it in that time or find additional problems. Wonderful, we can start working more together and I just continue assigning tasks. If they can’t get anything done within the first hour or two when they said they will. I will cut them.

To remove my bias on people and different backgrounds I do not have video calls. I only chat with them and write the issues they need in GitHub Issues. Sometimes I send a Loom video if there is something that can be explained better.

Seems like it is working thus far.

I’ve wondered why small teams work. What is it about them that drive results? I think the answer is that they empower people to make changes giving them ownership over the outcome. People have pride when they see their work actualized. They like to point and say I did that. It is a good feeling.

I'm looking to see how to setup Notion in such a way that it is easy to manage multiple teams as individual units. I don’t want them to really interact and as a secondary they should be provided value.

- Roles, Responsibilities, and Ownership

- Job Information

All jobs are created with the following information:

Job Description

A clear and concise description of the role.

Responsibilities

- Define what this position has ultimate responsibility and decision authority over.

- Clearly outline the products, services, assets, activities, and subordinates assigned to the position.

Expectations

- Specify the results required of the position to achieve the firm's objectives.

- Expectations should be:

- Clear, specific, and measurable.

- Focused on desired outcomes rather than activities.

- Open-ended and challenging to encourage experimentation and innovation.

Access

- Define what resources or systems the person is given access to and how they are expected to use them.

- Ensure each person is given the least amount of access needed to accomplish their job.

Training

- Provide the information needed to be most effective at their job.

- Include any specific principles or guidelines related to their role.

Routine

- If the job involves singular tasks, list them here.

- Link to recurring tasks that the role is responsible for accomplishing.

PRFAQ

The PRFAQ is a strategic document that helps you to clarify your product vision and define the customer problem you are trying to solve. It is a tool that helps you to think through the customer experience and the product features you need to build. The PRFAQ is a living document that evolves as you learn more about your customers and their needs. It is a tool that helps you to communicate your product vision to your team and stakeholders. The PRFAQ is a tool that helps you to align your team around a common goal and to ensure that everyone is working towards the same vision. The PRFAQ is a tool that helps you to prioritize your product features and to ensure that you are building the right product for the right customers.

Press Release

Heading: Name the product in a way the reader (i.e. your target customers) will

understand. One sentence under the title.

Subheading: Describe the customer for the product and what benefits they will

gain from using it. One sentence only underneath the Heading.

Summary Paragraph: Start with the city, media outlet, and your proposed launch

date. Give a summary of the product and the benefit.

Problem Paragraph: This is where you describe the problem that your product is

designed to solve. Make sure that you write this paragraph from the customer’s

point of view.

Solution Paragraph(s): Describe your product in some detail and how it simply

and easily solves the customer’s problem. For more complex products, you may

need more than one paragraph.

Quotes & Getting Started: Add one quote from you or your company’s spokesperson

and a second quote from a hypothetical customer in which they describe the

benefit they are getting from using your new product. Describe how easy it is to

get started, and provide a link to your website where customers can get more

information and get started.

FAQ - Customer

Segments

FAQ - Internal

Who is the customer?

Have a specific customer segment in mind. This is the most important part of the growth engine. The segment should be large enough to be worth your time, but small enough to be able to reach them. The segment should also be specific enough that you can tailor your message to them. The more specific the segment, the better.

What is the customer problem?

Is the most important customer benifit clear?

Hod do you know what the customers need or want?

What does the customer experience look like?

Other

Q: What happens if a customer encounters x? How does the product deal with use

case x? (there are likely to be several such questions).

Q: What are the challenging product engineering problems we will need to solve?

Q: What are the challenging customer UI problems we will need to solve?

Q: How will we manage the risk of the upfront investment required?

Q: Do we have any third-party dependencies to build this product? If so, what

are they and why will they be willing to partner with us (what is in it for

them)?

Q: What third-party technologies are we dependent on to function properly for x

to work as promised?

Q: Are there any potential regulatory or legal issues to consider?

Q: What are the per-unit economics of the product? That is, what is our expected

Gross Profit and Contribution profit per unit?

Q: What is the rationale for the price point you have chosen for the product?

Q: How much will we have to invest up front to build this product in terms of

people, technology, inventory, warehouse space, etc.?

Q: What/who are the current competitors for this product?

Competitors

Identify your competitors and what they are doing to grow their business. This will help you understand what works and what doesn't. You can use this information to tailor your growth engine to be more effective.

Make a list of each of the features that your competitors have and how they are implemented then use that information to build your own growth engine.

Deming

| Metric | Goal | Formula |

|---|---|---|

| Revenue Growth | 30% per year | |

| Asset Growth | 30% per year | |

| Free Cash Flow Growth | 100% per year | Free Cash Flow = Net Income + Depreciation and Amortization – Changes in Working Capital – Capital Expenditures |

| ROIC | 30% | ROIC = (Net income – Dividends) / (Debt + Equity) |

| Debt-to-Free Cash Flow | 400% | |

| Debt-to-Asset | 50% | |

| Effective Tax Rate | 12% | |

| Negative Cash Conversion Cycle | -30 days | Cash Conversion Cycle = Days Inventory Outstanding + Days Sales Outstanding - Days Payable Outstanding |

7 Powers

We optimize our growth engine around the 7 Powers framework. The framework is basically the following:

- Scale economies: A business in which per unit cost declines as production volume increases.

- Network economies. The value of a service to each user increases as new users join the network.

- Counter-positioning. A newcomer adopts a new, superior business model which the incumbent does not mimic due to anticipated damage to their existing business.

- Switching costs. The value loss expected by a customer that would be incurred from switching to an alternative supplier for additional purchases.

- Branding. The durable attribution of higher value to an objectively identical offering that arises from historic info about the seller.

- Cornered resource. Preferential access at attractive terms to a coveted asset that can independently enhance value.

- Process power. Embedded company organisation and activity sets which enable lower costs and/or superior product.

We build experiments that help us optimize each of these powers leading to competitive moat.

Marketing

Promotion

- Social Media. Use social media to promote your business. This can be done through paid ads, organic posts, or influencer marketing.

- Email Marketing. Use email marketing to promote your business. This can be done through newsletters, promotional emails, or drip campaigns.

- Content Marketing. Use content marketing to promote your business. This can be done through blog posts, videos, or podcasts.

- SEO. Use SEO to promote your business. This can be done through optimizing your website, creating backlinks, or using keywords.

- Paid Advertising. Use paid advertising to promote your business. This can be done through Google Ads, Facebook Ads, or LinkedIn Ads.

Sales

Partners

Seek out ~5 partners who can help you grow your business. These partners should be in the same space as you, but not direct competitors. They should also be willing to help you grow your business.

Email Prospecting

Closing the Deal (Challenger Sale)

- Listen

- Ask Questions, Lead Them

- Empathy

- Say Little, This is Therapy

- Slow Down, When Speaking

- Put Things in Customer Benefit

- Be funny 🙂

Step 1: The Warmer

“We are seeing the following three things at other companies like yours. Is there something you’d like to add?” This is where you start with a hypothesis of the company. What other companies have you worked at that face similar situations? Make it three things specifically. Get more data back.

Step 2: The Reframe

You need to present something to the customer that reframes their perspective. Not an "I totally agree," but a "huh, that is interesting." It needs to shock. If you fail to create this "huh, how interesting" moment, you’ve failed the sale because they’ve already thought through how to solve it themselves. Break the news that their problems won’t be solved with the solution they’ve imagined. Get within their OODA cycle and throw them into chaos so they must reframe and reorient their decision-making process around you. Shock them. Create a "huh / that’s right" moment.

Step 3: Rational Drowning

They need to feel like they truly need this solution. Make them consider the opportunity. Do not mention yourself at all. Reframe it with solid data. Why is this important? Provide examples of why this is important.

Step 4: Emotional Impact

The customer must see themselves in the story you’re telling with the solution. Paint a picture of other companies like theirs who went down a similar path. Highlight behavior that the customer will immediately recognize as typical of their own company. Help them glimpse into the future. During a successful Emotional Impact step, your audience will feel personally connected to your presentation because you’re giving them a scenario that resembles their own situation. Relate to their pain. Create a story that helps them feel the pain. What is the unhappy ending here? Have them be in the picture, but the ending doesn’t look good.

Step 5: A New Way

Talk about solutions, not about yourself. Discuss what the solution can do, e.g., the capabilities of the new system. Convince them how much better they would be if they acted differently. They need to buy into a solution before they buy your solution. Tell an alternate story with a happy ending. Describe a solution that could be generic.

Step 6: Our Solution

Demonstrate how our solution is much better than anything else out there. Explain how we have experience solving that exact need. Show how we’ve created a solution that allows them to scale and grow. Explain why our solution is better.

Finance

- Monthly Revenue Growrh

- Monthly Expense

- Gross Profit

- Free Cash Flow

- Each Microservice needs to also have an income statement associated with it in terms of revenue generated for it.

Ledger is our financial engine that is powered by hledger that:

- Uses AI to manage our books

- Calculates our taxes

The output of ledger are financial reports:

- Realtime Report

- Working Capital

- Ratios

- Revenue

- Free Cash Flow

- Negative Cash Conversion Cycle

- Return on Invested Capital

- Income/Expense

- Debt

- Microservice Report

- Income Statement

- Financial Statements

Financial Statements

Income Statement

- Income (is Revenue)

- The amount coming from sales

- Cost of Service / Cost of Goods

- What it costs to deliver the Sale

- Gross Profit

- Income – Cost of Service

- Should be positive otherwise business is not going to survive

- This is the cost income coming from delivering the goods

- Expenses

- The overhead of running a company including salaries, etc. that are not tied to delivering the goods.

- This is also where depreciation goes for stuff bought

- Taxes as well are here.

- Net Operating Income (Net Operating Profit)

- Gross Profit – Expenses

- This is what it costs to run the company

- Net Other Income

- This is money made from interest and other things unrelated to what the company produces

- Net Income (Net Profit)

- Total amount of profit / loss of running the company

Balance Sheet

The balance sheet is the cumulative growth of the company and so is an important document.

Assets = liabilities + owner’s equity

- Assets

- Cash

- Inventory

- Reduction in Inventory should increase Cash

- Accounts Receivable

- Think of this as a loan to the customer.

- Long Term Assets

- Buildings to have been bought a while ago and the value could have increased, but we can’t realize the change until we sell it.

- Liabilities

- Loans

- Long Terms

- Account Payable

- To vendors, etc. Think of money you owe as a loan the vendors gave you.

- Equity

- Retained Earnings.

- Money that isn’t withdrawn and reinvested into the company.

Question to ask:

- Is your cash increasing or is it increasing because of an increase in liabilities?

- Are your liabilities increasing to increase you cash?

Cash Flow Statement

The cash coming in and going out. Divided into three sections

- Operating Activities

- Cash from delivering our products and services.

- We want to increase the amount of cash coming here to be higher.

- The more money we get from operating activities the better.

- Increase cash flow by getting money faster from the customer, and delaying paying the supplier

- Investing Activities

- We need to invest money in the future so this is where we would do it.

- i.e Computers, machines, etc.

- There should be some investment here otherwise you are not investing in the growth of your company

- Financing Activities

- Money from loans, etc.

- How we get money from loans, our payments for loans, etc.

- Are you paying a lot of this? If this is how you are increasing your cashflow that isn’t necessarily good.

Free Cash Flow = Operating Activities – Investing Activities

Financial Ratios

Profitability Ratios

Gross Profit Margin (Income Statement)

Shows the basic profitiability of your product or service before overhead or expenes are added in.

grossmargin = grossprofit / revenue

- Is there a negative trend in gross_margin?

Operating Profit Margin (Income Statement)

operatingprofit[EBIT] = grossprofit – operating_expenses

operatingmargin = operatingprofit / revenue

- Watch the operating_margin to see if costs are increasing faster than sales?

Net Profit Margin (Income Statement)

After all the other expenses have been paid for including taxes, interest, etc. netmargin = netprofit / revenue

Return on Assets (Income Statement, Balance Sheet)

- How effective are we using out assets to generate a profit.

- Don’t want it to be too high because that means the company isn’t investing in new facilities and equipment.

returnonassets = netprofit / totalassets

Return on Equity

- What percent of profit you make for every dollar of equity invested in the company.

- “From an outside investor’s perspective, ROE is a key ratio. Depending on interest rates, an investor can probably earn 3 percent or 4 percnt on a treasury bond, which is eessentially a risk-free investment. So if someone is going to put money into your company – or if you’re going to invest in sombody ele’s business – he or you willl want a substantially higer return on equity.”

return on equity = net profit / shareholder equity

Leverage Ratios

Debt-to-Equity

debt-to-equity ratio = total liabilities / shareholder equity

If > 1 then there is more debt used to finance the growth. If less then there is less debt. Bankers love this number because it shows how much debt the company has taken on versus the equity.

Interest Coverage

interest_coverage = operating profit / annual interest charges

How much interest is paid every year compared to how much profit is being made.

- If it gets too close to 1 it is a bad sign.

- If it is a high ratio then the company can take on additional debt.

Liquidity Ratios

Current Ratio

currentratio = currentassets / current_liabilities

- Don’t want to be anywhere near 1 since that means you will barely be able to cover the liabilities that will come due with the cash yo’ll hae coming in.

- Don’t want it to be < 1 since you will run out of cash in the future.

- A number too high means that the company is sitting on its cash.

Quick Ratio

quickratio = (currentassets – inventory) / current_liabilities

The quick ratio shows how easy it would be for a company to pay off its short-term debt without waiting to sell off inventory or conver it into product.

Efficiency Ratios

Lets you know how well your balance sheet is doing.

Inventory Days and Inventory Turnover

- How fast can you move investory and convert it to cash.

Inventory Days

daysininventory = average_inventory / COGS / day

- Give the number of days inventory stayed in the system

- day is usually 360

Inventory Turn

How many times inventory turns over every year. inventoryturns = 360 / daysin_inventory

- How frequently you sell out your stock and had to replenish it.

- The higher the number of turns the tigher your management of inventory and the better your cash position.

- This is useful for retail

Days Sales Outstanding

Average Collection Period. How long it takes for customers to pay their bills.

days sales outstanding = ending accounts receivable / annual revenue * day

- day is 360 ending accouts receivable = from balance sheet

- great number for entrepreneurs

- bring this down as it gives how long it takes for customers to pay their bills.

- a high DSO is bad as it may mean the customers are in trouble.

Days Payable Outstanding

The inverse of Days Sales Outstanding. How long it takes for us to pay our bills. dayspayableoutstanding = ending Account payable / COGS / day

higher the DSO the less happy vendors are.

Total Asset Turnover

- A company with lower turnover isn’t using as effectively as a higher one

- How efficient you are at generating profit from the income.

totalassetturnover = reveneue / total assets

Return on Investment

Return of Inveatment is based on current value of money

- The hurdle rate is what the opportunity cost of of getting a return else where at the present value.

- What is the free cash flow generated by the equipment. This is the estimate per year.

- What is the duration of the life of the equipment.

Net Present Value (NPV)

Over a period of time

- Cash Flow Rate

- How much it will cost and how to estimate

Example: A project starts Year 0: It costs -10,0000 Year 1: It brings in cash of 2500 Year 2: It brings in cash of 4000 Year 3: It brings in cash of 5000 Year 4: It brings in cash of 3000 Year 5: It brings in cash of 1000 Discount Rate = What you could have earned elsewhere. Ex 6% So you would do:

NPV = -10,000 + 2500/1.06 + 4000/1.06^2 + 5000/1.06^3 + 3000/1.06^4 + 1000/1.06&5 = -10,000 + 13,239 = $3,239

- If NPV > 0 then accept

- The 6% (discount rate is an opportunity cost)

- The money is not free and could have been deployed elsewhere

- If NPV is greater 0 than it is larger return than 6% we would have gotten elsewhere

- If comparing different projects the project with the highest NPV has the highest return

Cash Conversion Cycle

How long it takes to replenish cash. day inventory outstanding + day sale outstanding – day payable outstanding

Inspiration

If I have seen further, it is by standing on the shoulders of giants.

Sir Isaac Newton

- Constellation Software

- Liberty Media

- Koch Industries

- Microsoft

- Bridgewater Associates

- Ametek

- Caterpiller

- Danaher

- Dover

- Graham Holding Company

- Honeywell

- Illinois Tool Works

- Jack Henry

- Marmon Holdings

- Roper Technologies

- The Scott Fetzer Company

- Thoma Bravo

- Transdigm

- Tyler Technologies

- Vista Equity Partners

- ValSoft

- Bloomberg

- Carlyle

- Apollo

- Two Sigma

- Blackstone

- Tiny